AUD/USD bulls celebrate a bullish reversal

On Friday, Australia's dollar is trading at its highest level since mid-November after recovering in February from an early setback this year. Major gains in commodity prices have propelled the Australian dollar's strength.

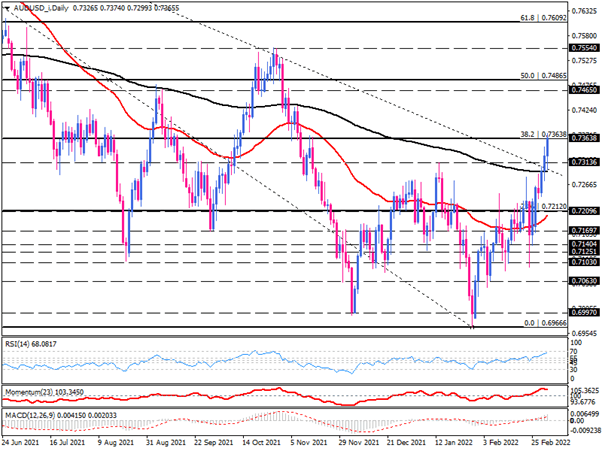

On the daily chart, Aussie was trending down in the last year. After sellers failed to make a lower low in late January, bulls took control of the market and rallied to 200-day EMA. It seems they will keep this bull party intact as they violated the confluence of resistances on the back of rising commodities prices. They overcame the 200-day EMA and falling trendline at one shot yesterday and are now challenging with the 38.2% retracement of the prior downtrend.

Moreover, a decisive break above the 0.73130 has confirmed the completion of a double-bottom pattern, which is a significant bullish reversal pattern. It won't be out of expectations if we see some consolidation at the current level. However, suppose buyers find enough strength to clear the 0.73638 barrier. In that case, the pair will be opened to test the next resistance area between 0.74650 and 0.74865. further positive momentum can push prices higher towards the five-month high at 0.75540.

Otherwise, if this height scares buyers and makes them retreat, Aussie may return to retest the broken trendline, aligning with the 200-day exponential moving average. Intensifying bearish momentum can result in a downside breakout that may drag prices down towards the 23.6% retracement at 0.72120.

Momentum oscillators support bullish bias. RSI is moving up in buying area, approaching 70-level. Momentum has chilled at the peak but is still confidently above the 100-baseline in buying territory. Likewise, MACD bars are growing in the positive region, distancing above the rising signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.