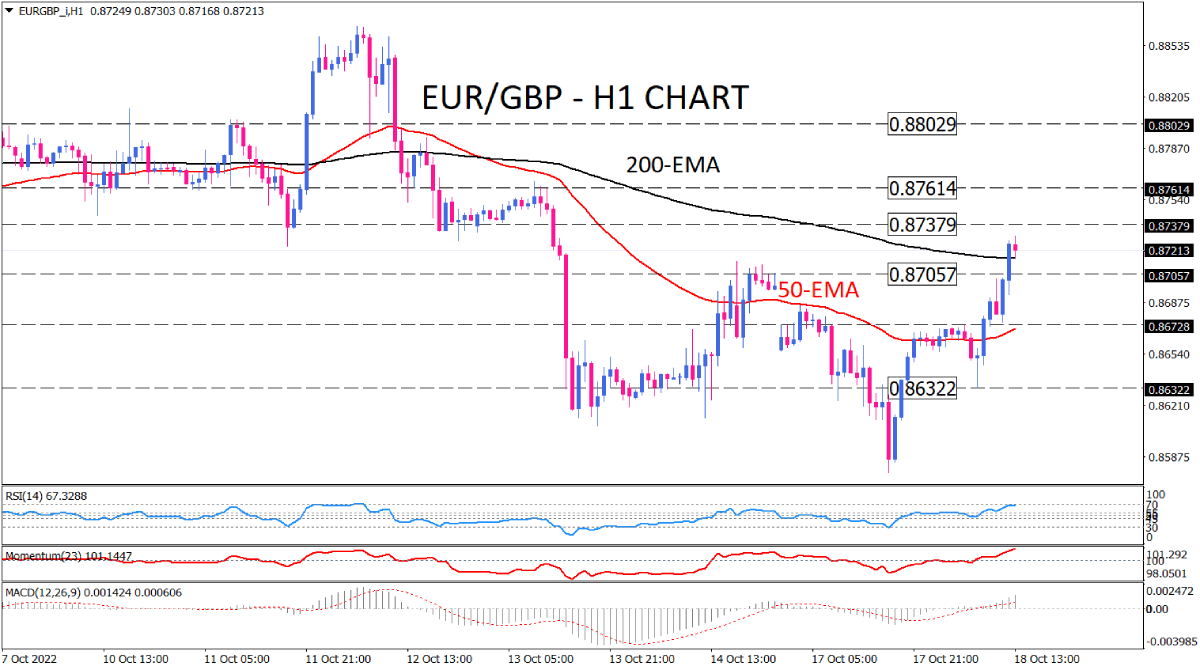

EUR/GBP buyers struggle with a key resistance area

Accelerating bullish sentiment has pushed the EUR/GPB beyond a critical resistance zone, standing around the 200-EMA on the one-hour chart. Should buyers manage to close the session above the 0.87200 barrier the market attention will turn towards the next level of interest around the 0.87515 mark. Keeping the ground above this latter will let buyers plan for conquering 0.87614. A clear breach of this area will put the 0.8800 into the spotlight.

Otherwise, if selling forces retake control, sellers may bring the price down to 200-EMA. A successful break of this hurdle will pave the way towards the lower dynamic support level around 0.86976, lining up with the 50-EMA.

Short-term momentum oscillators support upward movement. However, RSI is approaching the challenging area of the 70-level, which points to an overbought market, suggesting that buyers may get exhausted soon and take a break. If that happens w will see the price testing the moving average again. Momentum is rising, coming up into the buying region. Likewise, MACD bars are getting taller in the positive area, followed by upward signal lime, which represents intensifying bullishness in the market.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.