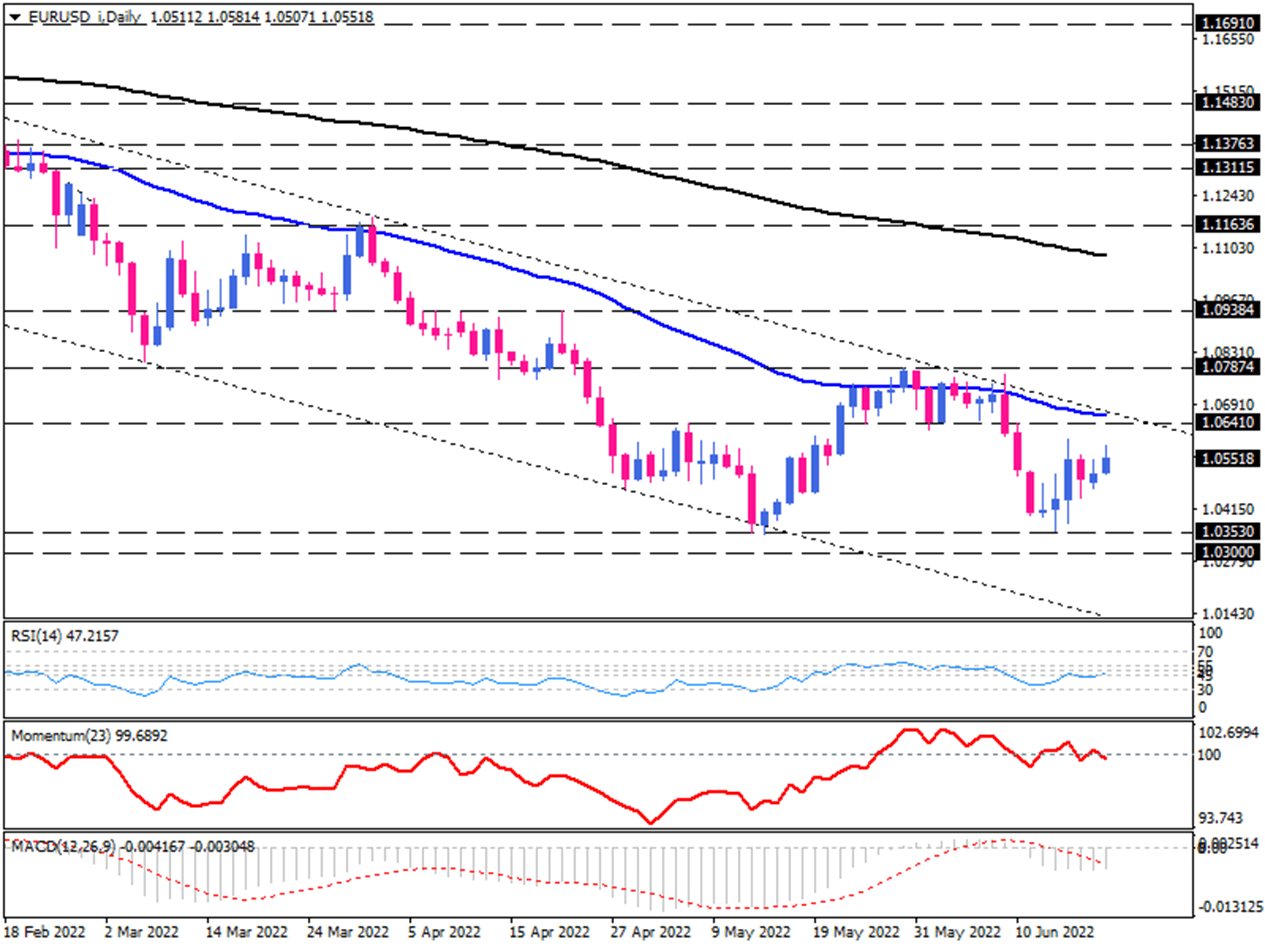

EUR/USD is looking for a direction after finding support around six-year lows

EUR/USD has been trading within a descending channel since early February on the daily chart. Due to monetary policy divergence between the ECB and Federal Reserve, prices have fallen below the 50-day EMA for a while as a result of the weakening euro. Nonetheless, the pair has bottomed around six-year lows at 1.03530 since ECB president Lagarde remarked that the bank would apply its first rate hike in July.

However, short-term momentum oscillators reflect a mixed picture. RSI is hovering in the neutral zone, attempting to find a clear directional indication. Likewise, momentum has been attached to the 100-baseline, suggesting no clear direction in the short term. While negative MACD bars are shrinking and may soon cross above the falling signal line.

As monetary policy tightens, buying pressure can mount, and euro buyers would urge to reclaim the upper line of the falling channel, lying at the 1.06410 price level in line with the 50-day EMA.

With sellers taking this resistance confluence into account, the price can drop back down to stay in the channel, targeting 1.03530 as significant support.

Otherwise, should that resistance confluence fail to halt the rally, the traction may continue towards the previous top of 1.07874, which was made on May 30. further upside momentum will likely result in a sustained break above this zone, pushing the pair toward the 1.09384 resistance.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.